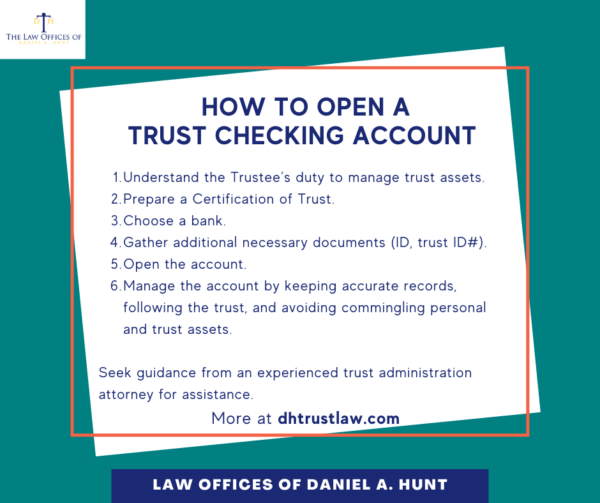

How to Open a Trust Checking Account in California

A trust checking account is a type of bank account that allows a trustee to manage and distribute funds according to the terms of a trust agreement. This type of account can be essential for estate administration and asset management, providing a clear separation of personal and trust assets. Here’s a step-by-step guide on how to open a trust checking account in California.

1. Understand the Trustee’s Duty to Manage Trust Assets

Before opening a trust checking account, it’s important to understand what a trust is and how it functions. A trust is a legal arrangement in which one party (the trustee) holds and manages assets for the benefit of another party (the beneficiary). Trusts can be created for various purposes, including estate planning, asset protection, and tax planning.

Where an acting trustee is not one of the trust creators, they owe a duty to the current beneficiaries of the trust to prudently manage the assets. An acting trustee has a duty to avoid commingling their own assets with trust assets, and to account for their financial actions to the beneficiaries.

2. Prepare Certification of Trust

A Certification of Trust is an extract of information from the trust and certifies that the trust is valid and has not been revoked. To open a trust checking account, you will need to present a copy of the Certification of Trust to the bank. According to California law, “The trustee may present a certification of trust to any person in lieu of providing a copy of the trust instrument to establish the existence or terms of the trust.”

The Certification of Trust includes key details about the trust including:

- Trust Name and Date: The official name of the trust and date it was established.

- Trustees: The individual(s) or entity responsible for managing the trust.

- Powers of the Trustee: The specific powers and duties of the trustee.

- Trust Identification Number: This may be a social security number or an employer identification number (EIN).

- Title Instructions: How title to trust assets should be taken.

By presenting a Certification of Trust instead of the full trust agreement, you can provide the bank with all of the information they need without sensitive information they do not need, such as the trust distribution scheme.

Some banks may demand a copy of the original trust agreement, but this contradicts California law. Under the California Probate Code, “Any person making a demand for the trust documents in addition to a certification of trust… shall be liable for damages, including attorney’s fees, incurred as a result of the refusal to accept the certification of trust in lieu of the requested documents if the court determines that the person acted in bad faith in requesting the trust documents.”

3. Choose a Bank

Selecting the right bank is crucial for managing your trust checking account. Consider factors such as the bank’s reputation, fees, customer service, and the types of accounts offered. Some banks specialize in trust services and may provide additional resources or expertise.

Here are some questions to consider when selecting a bank for your trust checking account:

- Does the bank offer trust checking accounts?

- What are the fees associated with the account?

- Are there any minimum balance requirements?

- Does the bank provide online access to the account?

4. Gather Necessary Documents

To open a trust checking account, you will need to provide certain documentation to the bank. Having these documents ready will help streamline the process. Often banks will require the following documents:

- Certification of Trust: A copy of the Certification of Trust document.

- Identification: Valid identification for the trustee(s), such as a driver’s license or passport.

- Tax Identification Number (TIN): The trust’s tax ID number or the settor’s Social Security Number if the trust does not have a separate TIN.

5. Open the Account

Once you have chosen a bank and gathered the necessary documents, you can proceed to open the trust checking account. This can typically be done in person at a bank branch or online, depending on the bank’s policies.

Here are some typical steps to open a trust checking account:

- Visit the Bank: Go to the bank branch or website to initiate the account opening process.

- Provide Documentation: Submit the required documents to the bank representative.

- Complete the Application: Fill out the account application form, providing details about the trust and the trustee.

- Fund the Account: Deposit the initial funds into the account as required by the bank.

- Review Account Terms: Understand the account terms, fees, and any special conditions.

6. Manage the Account

After opening the trust checking account, it’s important to manage it effectively to ensure compliance with the trust agreement and legal requirements. Regularly review the account statements and keep accurate records of all transactions.

Here are a few tips for managing a trust checking account:

- Keep Personal and Trust Funds Separate: Always avoid commingling personal and trust assets to maintain clear financial records.

- Follow the Trust Agreement: Ensure all transactions align with the terms of the trust document.

- Maintain Accurate Records: Keep detailed records of all deposits, withdrawals, and transactions.

As you manage a trust checking account, seek legal counsel from an experienced trust administration attorney who can ensure your actions comply with California law.

If you have any questions about how to open a trust checking account in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.